The HOW MUCH in this blog title could be describing overpayment or underpayment of your sales team. Where does your pay plan fall? Are you paying your sales people too much or could it be you are under paying them? Creating a sales pay plan isn’t terribly difficult but it’s trickier than finding a simple salary range for non-sales positions. I’ll answer the two most common questions asked of me regarding sales play plans. (1) How much should I pay my sales people? and (2) How should I structure the pay plan?

This blog was challenging for me to write because of the mathematical and accounting terminology. My goal in writing is always to help you learn without getting you lost, so hang in there with me. I’ve also included a Compensation Builder Worksheet for those interested in following this process. You can download the worksheet through the form at the end of the blog.

Sales compensation has a number of elements to consider. I take a Five Stage approach when building a sales compensation plan.

- Know your profit and sales goals as well as sales expense budget

- Assess the job factors of your sales position

- Determine Individual Sales Goals and Fair Compensation for your position

- Decide on a structure or blend of salary, commission and bonus

- Consider perks and benefits

The first place to start is figuring out what the company profit goals and sales budgets are.

1. What are the company profit goals and what’s the budget for sales compensation?

Before deciding on your plan structure or whether you should offer salary and/or commission, you first want to determine what your company needs in order to realize a return on sales revenue (gross sales profit), and what can be allocated to sales compensation. Here are the steps:

a. Determine your Gross Sales Profit (GSP), more commonly known as Gross Profit after Sales

Think of the Gross Sales Profit (GSP) as the amount of money needed to fund the current operation expenses and desired net profit. It’s what is left of top line Sales Revenue (SR) after you subtract Cost of Goods Sold (COGS) and Sales Compensation Expense (SCE). In the Figure 1 example the GSP target is placed at $1.4 million. 1.4 million is what this sample ABC Company has determined it needs to fund operations and realize their desired profit.

b. What is your COGS percentage of sales revenue (SR)?

In the Figure 1 example the COGS is 50% of SR. Half of every dollar sold has already been used up in producing or delivering the product. Divide your company’s current COGS by the SR on your financial statement to arrive at your COGS percentage.

c. Budgeted Sales Expense Percentage

What percentage of sales revenue are you willing to allocate to sales compensation (salaries, commissions, bonuses and expenses). Figure 1 shows the ABC company is willing to allocate 15% to sales expense. This percentage helps you have a check and balance as you build your compensation plan. You don’t need to use the whole 15% with sales but now you know you can.

d. Sales Revenue Goal

What is the sales revenue needed to produce the gross sales profit determined in point A? By working backwards with the GSP goal and other percentages, the answer of $4 million is what the ABC company needs to realize in Sales Revenue to attain the Gross Profit goal of $1.4 million.

Some people have said…huh, where did you get 4 million? Here is how I got there. We are allocating 35% of SR to GSP because we already know that 50% of SR goes to COGS and we just decided that SCE will be 15%. 100%SR = 50% COGS + 15% SCE + 35% GSP

Divide GSP of $1,400,000 by 35 (percentage number) = $40,000 (which is 1% of SR) … then … Multiply $40,000 time 100 (100%) = $4,000,000 (SR Goal)

2. Assess your job factors

A variety of job factors can affect your compensation plan design, ranging from conditions in your local market area to expectations about the duties sales people need to perform at your company. The purpose of considering these areas is to be fair about what you are offering and to have a justification behind your plan.

- What’s the local market offering for a similar position? It’s important to know this if you want to find the best people.

- Who is expected to generate the lion’s share of leads? Do you expect the sales person to generate leads or does the company invest in marketing to provide leads and open doors for your sales people to close business?

- What percentage of post-sales support is the sales person expected to provide? The more customer support required of a sales person the less sales time they have to find new business. This factor can impact your salary decision or individual sales goal.

- What level of industry experience and/or knowledge is required to be successful? If you have a specialized industry you might need to have a higher compensation program to attract and keep the limited number of candidates out there.

- How long is the average sales cycle? A longer sales cycle could require more salary or draw to keep a sales person afloat in between sales. You can always reduce the salary or commission once the sales person establishes their pipeline and sales flow. Of course you will increase commission if you lower salary.

- How many sales opportunities can be worked at one time? This can affect the sales goal as to how much a sales person can actually work.

- What level of “selling” expertise is required for a complex sales process? The more complex or higher level conversations required with many contacts in an organization can require more selling expertise and experience. These people will require more compensation as they have earned their skill through experience.

3. How much should you pay your sales people and how much should they sell?

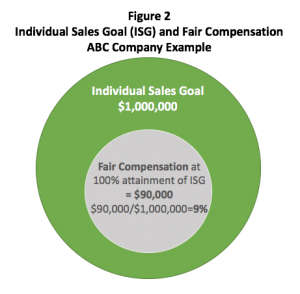

Fair Market Compensation: What’s fair compensation for a salesperson reaching their sales goal in your market? It’s wise to find some benchmark. You can still offer more or less based on your situation, but going into it blindly could be costly. You can check with your peers that have similar sales roles to get a feel for this as well as accessing a salary database (I’ve included a few sources) to gain perspective. If you are part of an industry association, they will usually provide benchmark data for compensation. They also might provide you with average sales by rep. The ABC Sample Company has determined that $90,000 is fair compensation for hitting their Individual Sales Goal.

http://salary.careerbuilder.com

Establish a realistic but stretch-worthy Individual Sales Goal

I usually check around with others in the industry to get a feel for this. As mentioned in the previous point, ask your industry association. Try not to use your own results or the super star you hired a few years ago. Owners and superstars are rare to find, so set goals based on above-average performers, but not top performers.

Test your Sales Compensation Expense Percentage

At this stage you want to determine your Sales Compensation Expense percentage and compare it to the budget percentage set in step c of section 1 above. Divide your Fair Compensation by the Individual Sales Goal. In the example, Figure 2, the ABC Company divided $90,000 of Fair Compensation by 1 million Individual Sales Goal for a 9% allocation of Sales Compensation Expense. The ABC Company budget called for 15%. The ABC Company now has 6% to use for incentives, apply to marketing or invest in more support to achieve their sales goals. When you work through this process if you find your numbers are upside down with the budget percentage you will need to make adjustments to one or more of the other financial factors to find a place that will attract talent and provide the profit the company needs.

Once you finalize the sales expense percentage to work into your pay plan it’s time to work on the structure of the plan.

4. How should you structure the pay plan?

I’ll continue to use the ABC Company financial numbers (9% for sale expense and $1,000,000 as the sales goal) to help illustrate a plan structure. The sample percentages are not a standard or benchmark. They are for illustrative purpose only. The ABC Company is in a great situation with a 6% cushion to work with. Let’s look at how to decide on a salary, commission or a blend.

Commission only with a draw

Commission only is easy to figure, it’s 9%. You might need to provide a draw to help people get started and to provide stability through the ups and downs of sales.

A draw is simply an advance on future commissions. When commissions are earned, any draws are subtracted from the commissions before a check is cut to the sales rep. I prefer offering salary plus commission as it provides the company greater return on over achievement and demonstrates your commitment to the sales person. In most cases with a draw, if a sales person does not perform, the company rarely recovers the draw, so in essence it’s a salary.

Salary plus commission

Salary plus commission is a little more complicated to build and the company does assume more risk. As with most investments, if you take a little more risk and monitor and measure your investment you can realize a greater return. It’s only risky if you don’t pay attention. Commission percentages are higher on draws and lower on salary compensations. When a sales person is selling at or over goal, the company is realizing a greater margin per sale with a salary program. Figure 4 and 5 illustrate the risk reward approach.

Salary Percentage Considerations

A lower salary or draw should be considered in the following situations:

- When sales goals can be achieved monthly due to the consistent number of opportunities in the market place available to sell. Security systems, office equipment or advertising are examples that would fit into this category. The more transactional and less complicated, the lower the salary can be.

A medium salary or draw should be considered in the following situations:

- When sales consistency happens more quarterly and monthly goals tend to be less consistent. Deal size varies more as well as sales cycle. Larger telephone or computer systems, mid-size commercial insurance or custom manufacturing can fall into this category.

A higher salary or draw should be considered if these situations exist:

- High-ticket sales with fewer sales opportunities and a long sales cycle.

- You have a proven performer and they prefer and perform better with a salary plus commission in any situation.

Commission Percentage with Salary

Figure 3 illustrates your percentage splits in the pay planning stage. As mentioned before you forecast for 100% goal attainment. In each split when the sales rep hits $1,000,000 in sales they earn $90,000 based on the mix or blend of pay elements (salary, commission and bonus).

Bonus

Bonuses can be used for hitting certain milestones, selling specific products, maintaining list price or whatever makes sense for your business. Bonuses should be a moving target that allows you to put emphasis on areas of the business you want to improve. You allocate a percentage of earning potential and then announce the bonus opportunities as needed.

Commission Percentage

In the three examples in Figure 3 the commission percentage is different. The high salary range pays a commission rate of 1.5%. The medium salary pays 4% and the low salary pays at 6%.

Risk/Reward

I touched on risk and reward a few points ago. Figures 4 and 5 will illustrate the different payouts when a sales person is exceeding goal by 50% and when he or she under achieves by 50%.

Now you can see how the risk reward works. The salesman takes on the risk at the straight commission or low salary and earns more when he performs. When the company takes on more risk with a higher salary, the company realizes more gross profit during higher performance. When companies reinvest this additional margin in marketing, service or sales incentives, a momentum can occur that results in consistently meeting and exceeding your goals. Sales people are willing to earn less if they have a great product and service to sell and a company that provides a great place to work.

Tiered Commission Percentage

To keep things simple in the illustrations I have purposely kept out tiered commissions. Tiered commission structures act like a performance bonus program that is built into a given sales period. A tiered commission structure has an increase in commission percentage as sales increase for a given period of time. You can use it weekly, monthly, quarterly or annually based on your product or service. A tiered approach can minimize risk on medium to high salary plans as well as provide a built-in incentive to exceed goal. Here is a simple example.

Monthly sales goal of $60,000

Sales between $1 – $30,000 realize a 3% commission

Sales between $31,000 – 60,000 realize a 5% commission

Sales between $60,001+ realize a 10% commission

5. Consider Optional Perks and Benefits

Sometimes it’s the smaller components of a comp plan that can mean the most to some sales people—similar to how the cup holders or interior trim in a luxury vehicle can make the difference in a car buyer’s decision. I’ve heard sales people tell me they are looking forward to earning their next promotion to receive the extra $300 for a car allowance. No bump in salary or increased commission—just an extra $300 car allowance. These comments come from salespeople who can earn an extra $1000 each month through the course of their normal activity. Hearing salespeople say these kinds of things reinforced for me how the little things count when it comes to a compensation plan. Consider the following items when wanting to attract and keep top talent:

- A car or mileage reimbursement

- Cell phone and service with enough data to keep them productive on the road

- Computer, tablet and data service

- Expense account for client entertainment (you can control this with pre approval or budget)

- Memberships in trade, social and recreational clubs and associations

- Health benefits

- PTO (sick, vacation and personal time off)

Download Tool – Compensation Builder Worksheet

If you are ready to tackle this project we have one more tool for you. You can receive a Compensation Builder Worksheet that can help you organize all your information to come up with a plan that works for the company and the salesperson. The worksheet is designed for those designing compensation plans.