Traditional Outsourced Sales Management is most often delivered in one of two models, a complete…

You’re Paying Your Sales People HOW MUCH?

The HOW MUCH in this blog title could be describing overpayment or underpayment of your sales team. Where does your pay plan fall? Are you paying your sales people too much or could it be you are under paying them? Creating a sales pay plan isn’t terribly difficult but it’s trickier than finding a simple salary range for non-sales positions. I’ll answer the two most common questions asked of me regarding sales play plans. (1) How much should I pay my sales people? and (2) How should I structure the pay plan?

This blog was challenging for me to write because of the mathematical and accounting terminology. My goal in writing is always to help you learn without getting you lost, so hang in there with me. I’ve also included a Compensation Builder Worksheet for those interested in following this process. You can download the worksheet through the form at the end of the blog.

Sales compensation has a number of elements to consider. I take a Five Stage approach when building a sales compensation plan.

- Know your profit and sales goals as well as sales expense budget

- Assess the job factors of your sales position

- Determine Individual Sales Goals and Fair Compensation for your position

- Decide on a structure or blend of salary, commission and bonus

- Consider perks and benefits

The first place to start is figuring out what the company profit goals and sales budgets are.

1. What are the company profit goals and what’s the budget for sales compensation?

Before deciding on your plan structure or whether you should offer salary and/or commission, you first want to determine what your company needs in order to realize a return on sales revenue (gross sales profit), and what can be allocated to sales compensation. Here are the steps:

a. Determine your Gross Sales Profit (GSP), more commonly known as Gross Profit after Sales

Think of the Gross Sales Profit (GSP) as the amount of money needed to fund the current operation expenses and desired net profit. It’s what is left of top line Sales Revenue (SR) after you subtract Cost of Goods Sold (COGS) and Sales Compensation Expense (SCE). In the Figure 1 example the GSP target is placed at $1.4 million. 1.4 million is what this sample ABC Company has determined it needs to fund operations and realize their desired profit.

b. What is your COGS percentage of sales revenue (SR)?

In the Figure 1 example the COGS is 50% of SR. Half of every dollar sold has already been used up in producing or delivering the product. Divide your company’s current COGS by the SR on your financial statement to arrive at your COGS percentage.

c. Budgeted Sales Expense Percentage

What percentage of sales revenue are you willing to allocate to sales compensation (salaries, commissions, bonuses and expenses). Figure 1 shows the ABC company is willing to allocate 15% to sales expense. This percentage helps you have a check and balance as you build your compensation plan. You don’t need to use the whole 15% with sales but now you know you can.

d. Sales Revenue Goal

What is the sales revenue needed to produce the gross sales profit determined in point A? By working backwards with the GSP goal and other percentages, the answer of $4 million is what the ABC company needs to realize in Sales Revenue to attain the Gross Profit goal of $1.4 million.

Some people have said…huh, where did you get 4 million? Here is how I got there. We are allocating 35% of SR to GSP because we already know that 50% of SR goes to COGS and we just decided that SCE will be 15%. 100%SR = 50% COGS + 15% SCE + 35% GSP

Divide GSP of $1,400,000 by 35 (percentage number) = $40,000 (which is 1% of SR) … then … Multiply $40,000 time 100 (100%) = $4,000,000 (SR Goal)

2. Assess your job factors

A variety of job factors can affect your compensation plan design, ranging from conditions in your local market area to expectations about the duties sales people need to perform at your company. The purpose of considering these areas is to be fair about what you are offering and to have a justification behind your plan.

- What’s the local market offering for a similar position? It’s important to know this if you want to find the best people.

- Who is expected to generate the lion’s share of leads? Do you expect the sales person to generate leads or does the company invest in marketing to provide leads and open doors for your sales people to close business?

- What percentage of post-sales support is the sales person expected to provide? The more customer support required of a sales person the less sales time they have to find new business. This factor can impact your salary decision or individual sales goal.

- What level of industry experience and/or knowledge is required to be successful? If you have a specialized industry you might need to have a higher compensation program to attract and keep the limited number of candidates out there.

- How long is the average sales cycle? A longer sales cycle could require more salary or draw to keep a sales person afloat in between sales. You can always reduce the salary or commission once the sales person establishes their pipeline and sales flow. Of course you will increase commission if you lower salary.

- How many sales opportunities can be worked at one time? This can affect the sales goal as to how much a sales person can actually work.

- What level of “selling” expertise is required for a complex sales process? The more complex or higher level conversations required with many contacts in an organization can require more selling expertise and experience. These people will require more compensation as they have earned their skill through experience.

3. How much should you pay your sales people and how much should they sell?

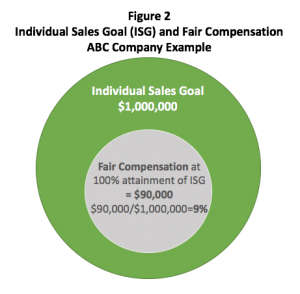

Fair Market Compensation: What’s fair compensation for a salesperson reaching their sales goal in your market? It’s wise to find some benchmark. You can still offer more or less based on your situation, but going into it blindly could be costly. You can check with your peers that have similar sales roles to get a feel for this as well as accessing a salary database (I’ve included a few sources) to gain perspective. If you are part of an industry association, they will usually provide benchmark data for compensation. They also might provide you with average sales by rep. The ABC Sample Company has determined that $90,000 is fair compensation for hitting their Individual Sales Goal.

http://salary.careerbuilder.com

Establish a realistic but stretch-worthy Individual Sales Goal

I usually check around with others in the industry to get a feel for this. As mentioned in the previous point, ask your industry association. Try not to use your own results or the super star you hired a few years ago. Owners and superstars are rare to find, so set goals based on above-average performers, but not top performers.

Test your Sales Compensation Expense Percentage

At this stage you want to determine your Sales Compensation Expense percentage and compare it to the budget percentage set in step c of section 1 above. Divide your Fair Compensation by the Individual Sales Goal. In the example, Figure 2, the ABC Company divided $90,000 of Fair Compensation by 1 million Individual Sales Goal for a 9% allocation of Sales Compensation Expense. The ABC Company budget called for 15%. The ABC Company now has 6% to use for incentives, apply to marketing or invest in more support to achieve their sales goals. When you work through this process if you find your numbers are upside down with the budget percentage you will need to make adjustments to one or more of the other financial factors to find a place that will attract talent and provide the profit the company needs.

Once you finalize the sales expense percentage to work into your pay plan it’s time to work on the structure of the plan.

4. How should you structure the pay plan?

I’ll continue to use the ABC Company financial numbers (9% for sale expense and $1,000,000 as the sales goal) to help illustrate a plan structure. The sample percentages are not a standard or benchmark. They are for illustrative purpose only. The ABC Company is in a great situation with a 6% cushion to work with. Let’s look at how to decide on a salary, commission or a blend.

Commission only with a draw

Commission only is easy to figure, it’s 9%. You might need to provide a draw to help people get started and to provide stability through the ups and downs of sales.

A draw is simply an advance on future commissions. When commissions are earned, any draws are subtracted from the commissions before a check is cut to the sales rep. I prefer offering salary plus commission as it provides the company greater return on over achievement and demonstrates your commitment to the sales person. In most cases with a draw, if a sales person does not perform, the company rarely recovers the draw, so in essence it’s a salary.

Salary plus commission

Salary plus commission is a little more complicated to build and the company does assume more risk. As with most investments, if you take a little more risk and monitor and measure your investment you can realize a greater return. It’s only risky if you don’t pay attention. Commission percentages are higher on draws and lower on salary compensations. When a sales person is selling at or over goal, the company is realizing a greater margin per sale with a salary program. Figure 4 and 5 illustrate the risk reward approach.

Salary Percentage Considerations

A lower salary or draw should be considered in the following situations:

- When sales goals can be achieved monthly due to the consistent number of opportunities in the market place available to sell. Security systems, office equipment or advertising are examples that would fit into this category. The more transactional and less complicated, the lower the salary can be.

A medium salary or draw should be considered in the following situations:

- When sales consistency happens more quarterly and monthly goals tend to be less consistent. Deal size varies more as well as sales cycle. Larger telephone or computer systems, mid-size commercial insurance or custom manufacturing can fall into this category.

A higher salary or draw should be considered if these situations exist:

- High-ticket sales with fewer sales opportunities and a long sales cycle.

- You have a proven performer and they prefer and perform better with a salary plus commission in any situation.

Commission Percentage with Salary

Figure 3 illustrates your percentage splits in the pay planning stage. As mentioned before you forecast for 100% goal attainment. In each split when the sales rep hits $1,000,000 in sales they earn $90,000 based on the mix or blend of pay elements (salary, commission and bonus).

Bonus

Bonuses can be used for hitting certain milestones, selling specific products, maintaining list price or whatever makes sense for your business. Bonuses should be a moving target that allows you to put emphasis on areas of the business you want to improve. You allocate a percentage of earning potential and then announce the bonus opportunities as needed.

Commission Percentage

In the three examples in Figure 3 the commission percentage is different. The high salary range pays a commission rate of 1.5%. The medium salary pays 4% and the low salary pays at 6%.

Risk/Reward

I touched on risk and reward a few points ago. Figures 4 and 5 will illustrate the different payouts when a sales person is exceeding goal by 50% and when he or she under achieves by 50%.

Now you can see how the risk reward works. The salesman takes on the risk at the straight commission or low salary and earns more when he performs. When the company takes on more risk with a higher salary, the company realizes more gross profit during higher performance. When companies reinvest this additional margin in marketing, service or sales incentives, a momentum can occur that results in consistently meeting and exceeding your goals. Sales people are willing to earn less if they have a great product and service to sell and a company that provides a great place to work.

Tiered Commission Percentage

To keep things simple in the illustrations I have purposely kept out tiered commissions. Tiered commission structures act like a performance bonus program that is built into a given sales period. A tiered commission structure has an increase in commission percentage as sales increase for a given period of time. You can use it weekly, monthly, quarterly or annually based on your product or service. A tiered approach can minimize risk on medium to high salary plans as well as provide a built-in incentive to exceed goal. Here is a simple example.

Monthly sales goal of $60,000

Sales between $1 – $30,000 realize a 3% commission

Sales between $31,000 – 60,000 realize a 5% commission

Sales between $60,001+ realize a 10% commission

5. Consider Optional Perks and Benefits

Sometimes it’s the smaller components of a comp plan that can mean the most to some sales people—similar to how the cup holders or interior trim in a luxury vehicle can make the difference in a car buyer’s decision. I’ve heard sales people tell me they are looking forward to earning their next promotion to receive the extra $300 for a car allowance. No bump in salary or increased commission—just an extra $300 car allowance. These comments come from salespeople who can earn an extra $1000 each month through the course of their normal activity. Hearing salespeople say these kinds of things reinforced for me how the little things count when it comes to a compensation plan. Consider the following items when wanting to attract and keep top talent:

- A car or mileage reimbursement

- Cell phone and service with enough data to keep them productive on the road

- Computer, tablet and data service

- Expense account for client entertainment (you can control this with pre approval or budget)

- Memberships in trade, social and recreational clubs and associations

- Health benefits

- PTO (sick, vacation and personal time off)

Download Tool – Compensation Builder Worksheet

If you are ready to tackle this project we have one more tool for you. You can receive a Compensation Builder Worksheet that can help you organize all your information to come up with a plan that works for the company and the salesperson. The worksheet is designed for those designing compensation plans.

Once you have finished your plan design you’ll want to take the time to document it. You can find a nice guide to creating a Sales Compensation Plan Description with this link.

There you go, easy as pie. One last thought. The compensation plan is only a piece of the success puzzle with salespeople. If you have not downloaded my Free Sales Management Guide you can learn more about it here. The Sales Management Guide will lay out the other critical pieces to put in place while building a high-performing sales team.

OR…you can hire us to be your Part-Time Sales Manager Now! Schedule a Meeting with Me

Well written…. clearly explained…. practical and useful.

Excellent Article. Well done. One of the most frequently asked questions of business owners. I would like to add that unless you have totally fixed pricing structures base commission on Gross Profit, and share with your salespeople. It makes them better business people and they will align more with company goals and will shoot for higher profits rather than beat the company down on pricing.

Spot on comment Allan. I have a couple of clients that pay their people on a salary + commission % of Gross Profit. You are right, it does put a check and balance in place to sell profitable business.

This won’t work unless the company discloses all the numbers for each sale or and/or it’s a commodity sale.

Michelle – You are right about disclosure and trust needed to make the gross profit model work. While I support a gross profit commission model with the proper trust and transparency I understand that a top line gross sales model is easier for most sales people to work under and puts the profit management back on ownership.

Right on with this answer. Disclosing all sales revenue may not be something a company wants to do. However, the base salary + a % of individual sales will work wonders. This promotes opportunity for every individual to succeed.

Hi Rene, you had mentioned that you had a couple of clients that pay their people salary + commission % on gross profit? Would you be able to tell me what a fair percentage could be in this case?

Thanks.

It’s hard for me to share a fair percentage without knowing what the gross margin is and how much of that margin is needed to operate the business. If you follow the example in the blog you can calculate the sales commission of 9% of “sales revenue” is also 25% of gross profit. You’ll need to do the math, but it works. That’s fair for the sample ABC company but I can’t say what is fair for your company. Call me if you want to discuss with more specifics.

Commissions on gross profit will only work on fixed pricing on commodity sales. If the salesman has no control over pricing, or issues with a projects “installation”, the salesmans compensation is at risk.

I will be interviewing with a company that resells a product and installs. Turnkey. If I’m not a partner of the company and just have a salary with commission, it should be based on the total sale. Otherwise they can screw me out of commission or hide the profit.

Thoughts?

My first thoughts are if you have any concerns about a company screwing you out of commissions, go find a better company. But…assuming you are just making a point of the possibility, I agree, if they want you to be based on gross profit you need to be in control of some of it and trust others are doing their best to keep the GP high.

I have a question for you.. I work for a company that sells resume writing/career development. I work with someone who takes the calls (she will usually sells one to two resumes per 8 hour period) and makes the sales and then I do all the writing, billing, paperwork, editing, delivery etc. Right now she is making 30% of the fee ( resumes run $400 to $500 ) …it takes her, at most, 30 minutes to make a sale and my part usually takes 6-8 hours. Do you feel her 30% is fair or is it too much?

Hello Delia,

Based on your info the person taking calls must be making about $50,000 a year give or take.

I used these averages:

Weekly resumes 7.5

Average sales $450

30% commission

50 weeks.

If his or her only job is to answer incoming sales leads that might be a little too much. If they have other duties and it allows you to produce the work it might not be too bad. Remember you do need someone to take those calls if you want to stay productive as people probably don’t just call and order. They need some convincing. As you can see from the article there is much more to consider building a compensation plan but I hope this provide some guidance to your question.

Thanks Rene for this information. I am wondering if you can help guide me…I have been asked to “sell” marketing services for a small marketing agency. They have proposed commission only but don’t know at what percent. They have a goal to generate $16,000 profit per month have $0 allocated for sales compensation…or sales development for that matter. I’m ok with straight commission but would like your POV on % commission. Thank you in advance for your thoughts.

Jean R.

Hi Jean – I can’t tell you what they should pay, but you need to look after you. Here is a question for you and some to ask the employer. How much should I be earning based on my skill and ability at this company or another? Not the dream target but the real target. Then go find out if the job can provide that by asking: If the company needs to earn $16,000 profit each month and I need to earn $________ each month, what will we need to sell the service for to reach our goals? How many customers will need to be sold? Is it possible? Can we all live with this and not be changing it later? It needs to be a win-win or it will never work. I hope that helps.

I am trying to determine whether my salary is adequate for my revenues generated. Currently I am the top salesman in our company for the past decade generating over 5,000,000 each year. I make approximately $65,000 with my car allowance. Is that a fair salary for that kind of revnue? This is for a wholesale door company – I live in Pennsylvania.

Hi Kerri,

Thanks for sending me the information via email. I hope my answers helped you out.

Hello,

I have built a good independent sales business in food and beverage brokering suppliers to distributors and selling for distributors to retailers. I worked for the big guys for 15 years before doing this for the last 8 and gross 120k. One of my distributor clients has offered to bring me in full time exclusive. 75k plus commission which i need to get back to him on which is the question what percentage commission should i ask for. $600 a month Car and 10% equity vesting 2% a year. Obviously I’m giving up being my own boss so should the commission be at 2%, 4%, 5%. I will be the sales manager and doing training and recruiting. Although not discussed im assuming i would not get commission on sales rep i hire which then make me think it should have a bonus component as well. How much of a premium should the package be to what i currently make on my own?

Hi Mike. I think we took this offline. I hope things worked out for you.

Hi Rene,

I work part time 3/4 days per week and have taken a companies online sales from 0 to 1m/yr in a just a few years and have increased average margins also. What would you think was fair / average compensation for this? I earn a small fraction of the 90k in your example.

Hi Fiona,

Send me more details about your job and what you do to my email address. All sales jobs are not the same. Also the 90,000 to 1 million in sales example is just that. It’s not a standard. In that example the company has enough margin to make this choice and still provide support and profit.

I realize this is an old post but was just wondering what your thoughts are on a salary + commission % of net profit model considering using a relatively accurate expense multiplier?

Hi Meredith,

Using net profit is fine. The point to understand is making sure the company is profiting with the model and the sales person is receiving a fair compensation.

Another point to keep in mind is the easier the commission calculation is the better the plan in the sales persons mind. If a sales person can quickly calculate what they will earn it becomes more personal and it can tap into their internal motivators. Conversely, if it’s too complicated, they just wait to you tell them what they have earned. Not a bad thing but a missed opportunity.

Very nice article. Thank you!

I have a few questions

Is 9% on sales value a norm or you just used it as an example?

Does this 9% include benefits like health insurance, housing allowance, car/ conveyance allowance, Gym allowance?

I negotiated a bad starting salary for me. If I calculate my salary in terms of sales value then first First year I got 10% of my sales value as salary. Second year it was again 10%. Third year it was 7% of my sales. Fourth year it was 6%. This is my fifth year which is completing in December and my salary to sales percentage is expected to be 6. This salary include commission and Bonus. Benefits include company car and health insurance.

I feel myself underpaid. What do you think? How can I change the situation?

Hello Majid, 9% is just an example. I was not including the benefits in the example, but as I said it is only an example. It sounds like you are selling more. Most of the time you have a salary plus commission the overall percentage of earnings per sale will go down as you sell more. Look at the article “commission percentage” it addresses risk and reward. The company took the risk with salary and you earned a higher percentage when you sold less. Now the company gains a bit more as you sell more. If you want to negotiate a larger or more consistent percentage ask if the company is willing to put you on full commission, no salary and negotiate a percentage. You also might negotiate where you earn bonuses by hitting higher milestones or higher commission percentages. Let me know how it goes. Lastly – don’t look at it as a bad negotiation to start, it is what you thought was right at the time. Now you try and adjust.

Any difference for commissions at corporate level selling when royalty revenue is all that matters?

Example: Salesman does $1,000,000 in sales for franchisees returns just 10% back for the corporate office in royalties, $100,000. What % of this royalty ($100,000) should the salesman get commission for?

Hey Tony – sorry about delayed answer. If I hear you correctly, you are securing clients or franchisees who go out and sell, and corporate (the Franchise) receives the 10% royalty on those sales. Your job is to secure the franchisee or client. The sales compensation on the royalty will vary based on how much effort is put in by the sales person after the contract is established. If very little is needed by sales to keep client in contract that very little if anything will be paid to sales as the support departments are “keeping” the business. If sales has service duties with the client or franchisee then a larger percentage can be worked out. This is also a position where a generous salary plus bonuses are paid based on total royalty revenue or new clients signed up.

Actually the job of the salesman in this scenario is to get sales for the local franchisee. However because he works for corporate, corporate only sees the revenue he “wins” as 10% of the total (the royalty) not the full 100% like if he was a salesman for one of the individual local franchises. Also once the sale is landed he really does nothing after that, it is up to the local franchisee to work it.

So the salesman might be doing the same amount of work to get a client for a local franchisee but is only making 10% sales for corporate so how is corporate supposed to pay him and remain profitable. Using your 9% number if someone working for a local franchise brought in 1M in business hed roughly make 90K. However if the same guy does 1M for corporate because corporate only gets 10% of that would he only earn 9K? Or because its just straight revenue he should get 30-35% thus still falling under the many times proposed 35% cost of sales barrier many use…

Tony….the percentages in the blog are all samples not standards. The key factor are what is the Gross Margin for the revenue, then how of that gross margin can be allocated toward sales. The other factors to consider are the market for this type of position. What do sales people earn roughly in this role? Give me a call and we can discuss. It’s a little tough working through via one way communication like this.

Hi Rene,

Really good article. Can I get some advice, We are an SME IT services company taking on our first sales person. Up to now myself as business owner has done most of the sales so we have never had a proper commission structure. We are planning a medium salary percentage commission based on GSP. We plan to have the sales person focus on new Business Development. As this is a new role with no sales processes in place and trying to find new business it will be difficult to get started. Should we (A) increase the base salary for year 1 or (B) give and advance on commission . Help much appreciated ..Joe

Hi Joe – Before adjusting salary….get the sales process nailed down, market you want them to go after, expectations set and a job description that is very clear. If you need help with this give me a call. After that is done, hire well. Don’t go for the IT background, although they need to be tech oriented, they do not need to know networks, as you already do. YOu need someone who focuses on finding more opportunities with companies that are not happy with their current solution.

I know this is an old article but I am currently working on a presentation for my current employer (cell phone sales) to rework our structure to be more beneficial to our employer and our employees. Currently the owner has decided that among 40+ locations everyone has the exact same goals. Whether a store makes $40,000 in Gross Profit or $9000 Gross Profit everyones goals are the same which leads to more than half of the employees not making any compensation over the base minimum wage. This is the reason I am working on a big presentation for my corporate office. While I understand the business is different but if more than half of the sales reps make Zero commission would it not be logical to rework the system to give people a reason to sell? Most people would agree we deal with the stress of sales for the payout, without that payout it is not worth it. Right now it is a tiered system with tiers ranging from 2.5% to 13%, more than half of our employees do not even make the 2.5%. I realize i could go somewhere else but I would like to help fix a company disconnected from reality and help it grow not just leave it in the dust.

[…] one of our past blogs, “You’re Paying Your Sales People How Much?”, we covered how to design a pay plan that is profitable to the company and to your sales people. […]

We are a industrial services company, industrial steel fab and machining, sales & service of hydraulic cylinders and pumps., customer base includes municipalities, Dept. of Def.,

Universities and other lower tier schools, construction contractors, refineries…and are in our 5th year of operation. We are making a concerted effort to grow our sales staff and are working on formulating a sales compensation package to include base + commissions… Question: what is an appropriate ratio of total compensation (base plus commissions plus everything else) to (GP)gross profit produced, (e.g. for the year, a sales person makes $75,000 in base+GP)…is a healthy scenario for the company to expect that sales persons efforts to generate 3X, 5X, 10X…on the $75K?

Hi Rick – it was nice discussing this with you on the phone, thanks for setting up the time to meet. For others, I don’t have a standard answer for the “healthy” scenario mentioned in Rick’s comment. It will vary by industry and market conditions. What Rick and I did discuss was to use a top end of 33% of gross profit as a guide for sales compensation. Ex. If you sell $1,000,000 with a 30% gross profit ($300,000 GP), and you allocate a maximum of 33% to sales compensation, you have $100,000 set aside for sales. Again, this is not for every company but can be a guide to start from.

correction: in the example, the sales person makes $75,000 in base + commission

Rene,

I must be missing some part of the thought process for using GP. Last year was a bad year and sales dropped to just under $12 million. GP was 22.8% (pretty normal). Net Profit was negative $200,000.00. I understand that our issue is with needing to increase sales to about $15 million to show an approximate 2% Net Profit. Knowing that, I can’t seem to come up with a method of determining SCE allocation?

Hi Michael – The SCE allocation is determined by defining what fair annual compensation would be for a sales rep in your market and industry, and what is a goal the company believes should be delivered for that compensation. In the blog fair compensation (found by researching or asking around) for the sample company role is $90,000 and the company determined goal is $1,000,000. Which now creates a 9% SCE percentage. This exercise is to test how your current SCE% is stacking up against what you have deemed fair to the employee and company through an objective process. It can help you see if you might be paying too much or too little for what is expected. Reach out if you want to discuss it over the phone. https://go.oncehub.com/renezamora

[…] we aren’t making action in providing the correct compensation plan. Maybe we aren’t making action around specific training that is needed. Maybe we aren’t […]

[…] goes into building a Compensation Plan. One of the most popular blogs on our website is titled, “You’re Paying Your Sales People How Much?” The blog goes over a 5-Step Approach you need to go through in making sure that you have a […]

please send the Compensation Builder Worksheet and any other related docs you feel we would find useful. Thank you

10-4. It should be in your email box. If you not, send me a personal email and I’ll forward. Thanks.